Conducting a Competitive Analysis

Conducting a competitive analysis is crucial in staying ahead of the game in such a fast-paced environment. It may not be the most exciting task, but it’s key to understanding your audience’s expectations and your brand’s position in the market compared to its competitors. In this article, I’ll break down the key steps in conducting a competitive analysis along with examples.

What is a Competitive Analysis?

The standard definition is a process that involves identifying and researching a brand’s competitors to reveal their strengths and weaknesses compared to your own. It gives you a clear picture of your targeted market and provides insight into the consumer’s point of view. This research can be used to find opportunities to grow and improve your brand. It’ll also help you identify differentiators to appeal to your audience.

A competitive analysis doesn’t have a singular, best approach. It can vary based on the industry, company goals, and many other factors. Here’s a list of key components that are typically included:

- Competitor’s features and products

- Pricing

- Target Audience

- Differentiators

- Strengths

- Weaknesses

Steps to Conduct a Competitive Analysis

1. Identify Competitors

This first step is relatively simple but it lays out the steps ahead. You must identify all competitors in the brand’s industry, including direct, indirect, legacy, and emerging competitors.

- Direct competitors – Offer the same products/services and target the same audience

- Indirect competitors – Aim to solve the same problem but provide a different solution

- Legacy – Established companies that are known and trusted

- Emerging – New players in the market with an innovative business model that poses a threat to existing businesses

We will use the example of Hydro Flask and their insulated water bottles to conduct this competitive analysis.

|

Type of Competitors |

Brands |

|

Direct Competitors |

Yeti, S’well, Camelbak, Contigo |

|

Indirect Competitors |

Nalgene, Brita, Thermos, Tupperware |

|

Legacy Competitors |

Stanley, Thermos, |

|

Emerging Competitors |

Corkcicle, Takeya, Owala |

2. Market Research

Once you’ve identified your competitors, research the brands and the market to collect data to complete your analysis. To get a well-rounded overview make sure to do a mix of primary and secondary research. Primary research can include interviewing customers, conducting surveys, and in-person focus groups. Secondary research can include competitor’s websites and records, assessing the economy, and identifying technological developments.

3. Compare Product Features

With the data from Step 2, analyze and compare your key competitors based on key factors such as quality, price, customer service, and brand reputation. This will provide a benchmark to compare each brand. It’s important to focus on what the competitors are doing well and what they are doing poorly. This can help identify ways for your brand to grow or find shortcomings you can improve to stand out.

Here’s an example of benchmarking the brand Yeti:

|

Criteria |

Yeti |

|

Quality |

|

|

Price |

|

|

Customer Service |

|

|

Brand reputation |

|

4. Determine Market Position for Competitors and Yourself

Now that you have a benchmark on all of your competitors, it’s time to determine the market position for you and your competitors. Market position is determined based on the market share of the brand and customer satisfaction. It’s typically visualized on a graph with four quadrants representing the categories niche, contenders, leaders, and high performers.

- Niche – Low market share, low customer satisfaction

- Contenders – High market share, low customer satisfaction

- Leaders – High market share, high customer satisfaction

- High Performers – Low market share high, customer satisfaction

This visualization is important because it shows you where you are in the industry and also identifies the leading competitors. It’ll also help identify areas in the market that have gaps and opportunities to grow and compete with current competitors.

Here is a market position map for our Hydro Flask example. With a strong, developed brand like Hydro Flask, the goal would be to focus on brands in the top sections, high-performers and leaders.

5. Conduct SWOT analysis for each competitor

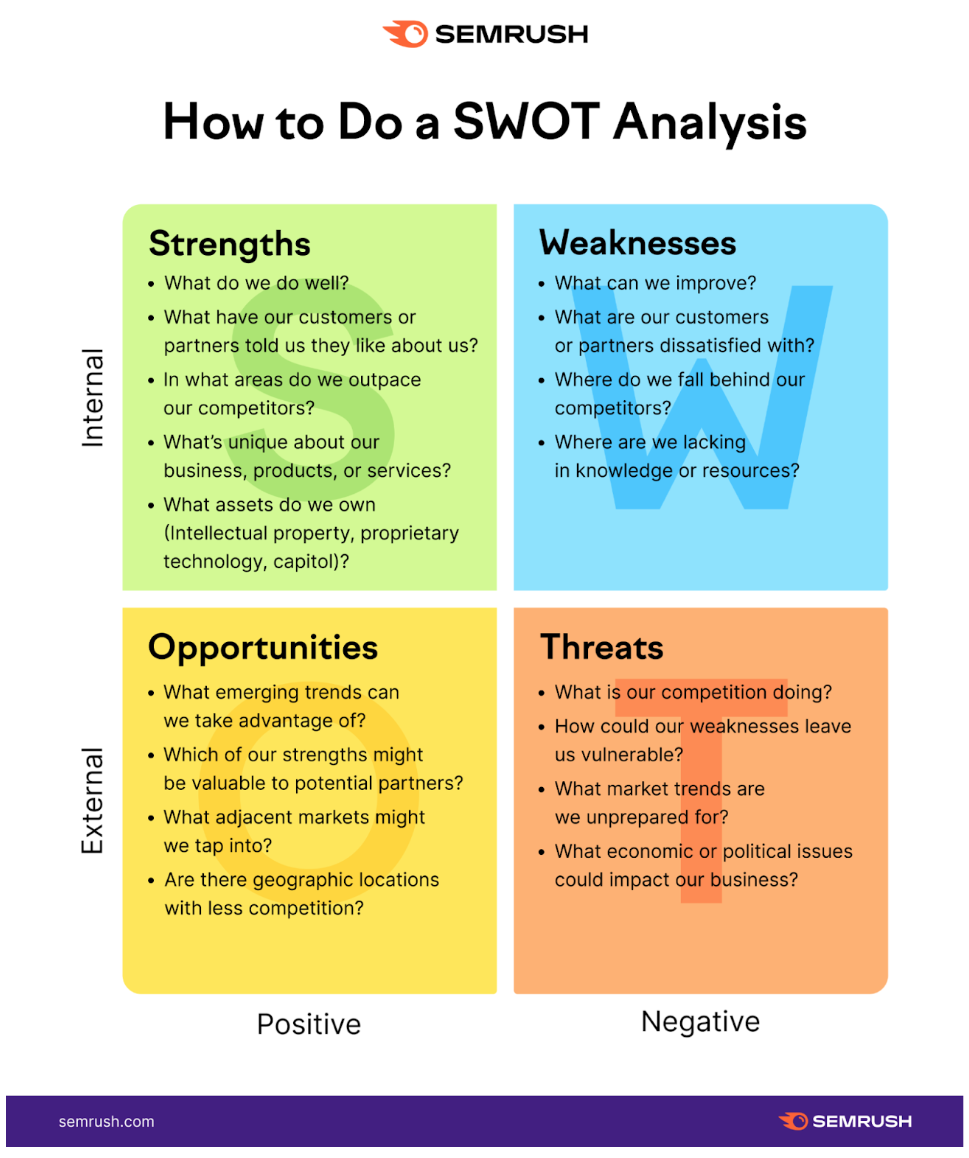

A SWOT analysis stands for strengths, weaknesses, opportunities, and threats. It’s a tool to analyze internal (strengths and weaknesses) and external (opportunities and threats) factors that may affect a company in reaching its goals. It’s essentially the final step to compile your research and findings from the competitive analysis. Below is a template from SEMRUSH to conduct a SWOT analysis:

Here is an example of a SWOT analysis conducting on the brand Yeti:

6. Analyze findings to create a unique strategy

Now that you’ve compiled and analyzed your data, it’s time to consider how to adjust and position your company’s offering to stand out from your competition. Though this is an extremely beneficial report, it’s important to remember that the market is constantly changing so the data collected will need to be updated. Many recommend that a competitive analysis be done every month, but at least once a quarter to ensure you have an accurate representation of your company and the market.

It’s important to remember that this analysis isn’t done to copy your competitors. It’s used to gain insight into what your target audience wants within your industry and to identify different ways to differentiate your brand from its competition. Never lose sight of the mission and vision of your brand, especially when looking at other companies.

0 Comments